Tax relief on training costs in the UK depends on your employment status and the type of training. Employers can deduct work-related training expenses, such as leadership training costs or professional skills courses, from their taxable profits. Employees generally benefit when their employer covers training costs, as these are tax-free and do not count as a benefit-in-kind. Self-employed individuals can claim relief only for training that maintains or updates existing business skills, not for learning new trades.

This guide explains eligibility, qualifying training types, and how to claim relief, including documentation requirements. Follow the outlined steps to ensure compliance with HMRC rules and maximise allowable claims.

For more details, explore training providers and programmes through our directory.

30 Allowable Expenses You Can Claim to Reduce Tax Bill

Who Can Claim Tax Relief on Training Costs

Eligibility for tax relief on training costs depends on your employment status. If you're self-employed, you can only claim relief for training that directly updates skills relevant to your current trade. Employers, including limited companies, can deduct costs for work-related training, while employees can claim relief only when their employer pays or reimburses the expense. Below, we outline which types of training qualify and which do not.

Training That Qualifies for Tax Relief

To qualify for tax relief, training must be directly related to your current business or job. For self-employed individuals, this includes courses that improve existing skills or help adapt to changes in the industry. For example, HMRC allows a gas boiler fitter to claim training costs for a heat pump installation course, as it updates skills relevant to their trade. Similarly, a wedding photographer taking an online refresher course in photo editing can claim relief, as it enhances essential business skills.

Employers can claim tax relief for "work-related training", which HMRC defines as any activity designed to improve knowledge, skills, or qualities that are useful for an employee's role. This includes leadership development, executive coaching, and professional skills training. Programmes such as Outward Bound, Raleigh International, or the Prince's Trust are also eligible, provided the skills gained are relevant to the employee's duties. Additionally, incidental expenses like travel, subsistence, and course materials can also be claimed.

Training That Does Not Qualify

Training aimed at starting a new trade does not qualify for tax relief. For instance, HMRC has denied relief to individuals training to become approved driving instructors or freelance makeup artists taking tattooing courses to open a new studio.

Courses related to personal interests or hobbies that do not directly enhance current job performance are also excluded. For example, a shop owner pursuing a sports science degree to better understand customers was denied relief because the knowledge gained did not directly aid in selling sportswear. For employees, training provided as a reward for performance, rather than to develop work-related skills, is taxable. Similarly, recreational activities with no connection to work-related learning, such as an evening at a go-kart track, are not eligible for tax relief.

Tax Relief Rules by Employment Status

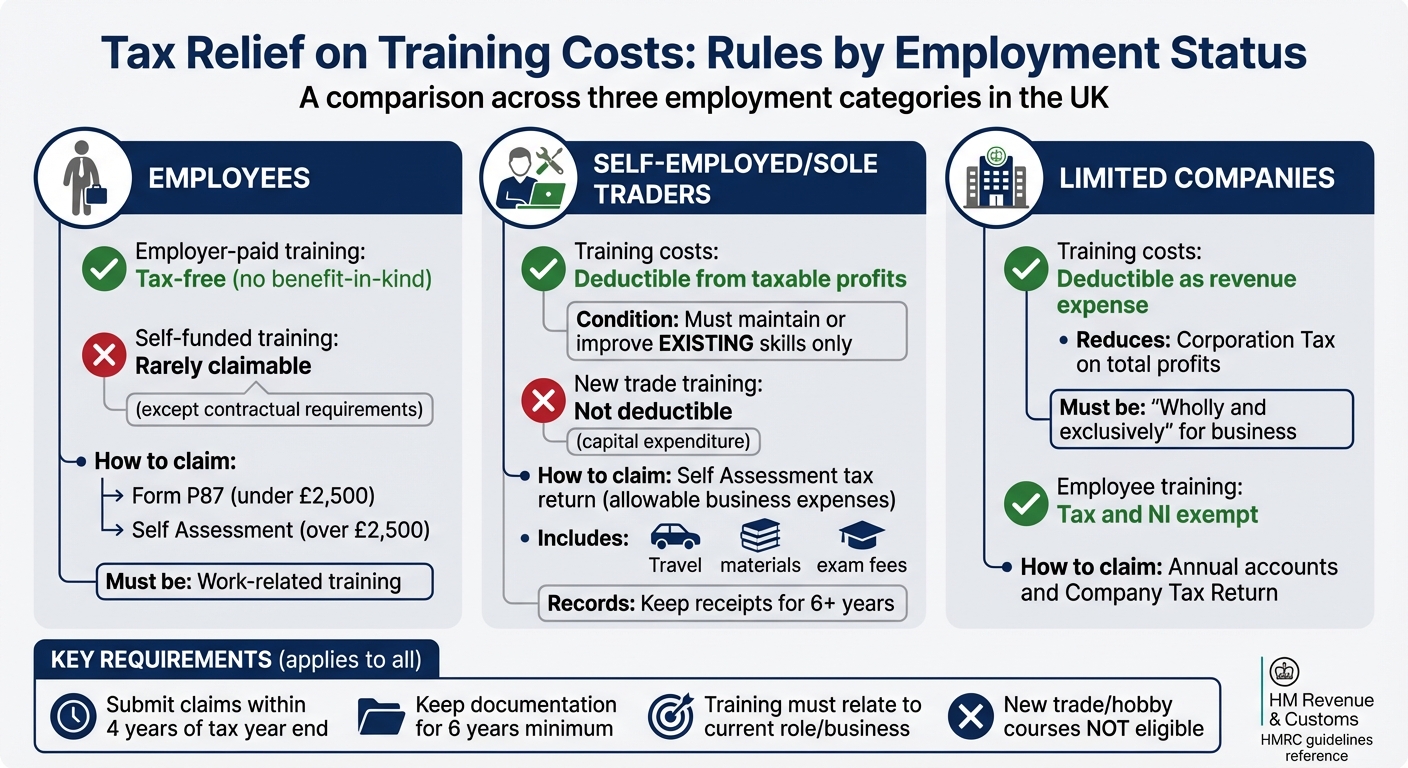

UK Tax Relief on Training Costs by Employment Status

The rules for claiming tax relief on leadership training expenses vary depending on whether you're an employee, self-employed, or operating as a limited company. HMRC has specific guidelines for each category, outlined below.

Employees

If your employer covers the cost of leadership training, it’s generally tax-free and doesn’t count as a taxable benefit-in-kind, as long as the training qualifies as "work-related" under HMRC rules. This can include leadership development programmes, executive coaching, or team-building initiatives like Outward Bound or Prince's Trust activities.

On the other hand, if you pay for your own training, claiming tax relief is rare unless it’s a contractual requirement, such as for trainee doctors. For expenses under £2,500, you can claim using form P87. For higher amounts, these should be included in your Self Assessment tax return.

Self-Employed and Sole Traders

If you’re self-employed, you can deduct training costs from your taxable profits, but only if the training is aimed at maintaining or improving skills you already use in your business. For example, courses in financial management or team leadership are allowable, as they help you manage your current business more effectively. These costs can include travel, materials, and exam fees.

However, training for a completely new trade is considered capital expenditure and isn’t deductible. You’ll need to report eligible training costs in the "allowable business expenses" section of your Self Assessment tax return and keep receipts for at least six years.

Limited Companies

For limited companies, leadership training costs can be deducted as a revenue expense, reducing total profits before Corporation Tax is calculated. This applies as long as the costs are "wholly and exclusively" for business purposes. Training for directors, employees, or other staff members qualifies under these rules.

When a company pays for an employee’s training, it’s treated as "work-related training" and is exempt from tax and National Insurance. Make sure these expenses are recorded as revenue costs to lower the company’s taxable profit.

sbb-itb-fa39ac2

How to Claim Tax Relief: Step-by-Step

Claiming tax relief involves a straightforward process, but the exact steps depend on your employment status. Generally, you’ll need to gather the right evidence, submit your claim, and keep thorough records. Below, we outline the process for managing your documents, submitting your claim, and meeting record-keeping requirements.

Collect Required Documents

Since 14 October 2024, HMRC requires all Pay As You Earn (PAYE) employment expense claims to include supporting evidence before processing. This applies to claims submitted using form P87 or the online iForm system. Essential documents include receipts or invoices showing the course name, date, and proof of payment. These documents must also indicate which employment the training expense relates to and whether your employer reimbursed any costs.

For training that involves travel, keep a mileage log specifying the purpose of each journey, as well as the start and end postcodes. For overnight stays, retain receipts for accommodation and meals that clearly show the date and the establishment's name. If you’re self-employed, maintain a training log that explains how each course supports your business, such as updating skills or staying current with industry developments.

Submit Your Claim to HMRC

Employees with expenses up to £2,500 can use form P87 or the online iForm (introduced on 20 December 2024). If your expenses exceed £2,500, you’ll need to register for and complete a Self Assessment tax return. For postal submissions, send your completed form P87 to: Pay As You Earn and Self Assessment, HM Revenue and Customs, BX9 1AS. If you’ve previously claimed the same expense and the total is under £2,500, you might be able to submit your claim through the HMRC helpline.

Self-employed individuals and sole traders should claim training costs in the allowable business expenses section of their annual Self Assessment tax return. Limited companies can include training costs as business expenses in their annual accounts and Company Tax Return, which helps reduce Corporation Tax. HMRC has stated:

When customers send us evidence for PAYE employment expense claims, HMRC will check it and confirm whether they are entitled to tax relief.

Once your claim is submitted, ensure all documentation is organised and retained to comply with HMRC’s requirements.

Record Keeping and Deadlines

You must keep all supporting evidence for at least six years to meet HMRC’s compliance standards. This includes receipts, invoices, course details, and proof that the training is business-related, such as course syllabuses or certificates. Claims must be submitted within four years of the end of the tax year in which the expense was incurred. For instance, training costs from the 2024/25 tax year (ending 5 April 2025) must be claimed by 5 April 2029.

Although the claim window is four years, the six-year retention period ensures you’re prepared for any compliance checks. Keeping digital copies of receipts can also streamline the process if you’re using the online iForm system.

What You Can Claim and Common Mistakes

Expenses You Can Claim

When it comes to claiming tax relief on training, you can include several direct costs:

- Tuition fees, exam fees, and registration with professional bodies

- Course materials such as books, stationery, and multimedia resources

- Travel and accommodation expenses related to the training

For employees, incidental expenses like additional childcare costs incurred specifically due to training are also eligible. Travel, overnight accommodation, and other minor expenses previously mentioned may be included as well.

Training in areas like leadership, time management, stress management, and communication is deductible if it benefits the business. According to HMRC, the personal satisfaction gained from such training does not affect its deductibility, provided the training is relevant to the business. However, self-employed individuals must follow stricter rules: the training must maintain or update existing skills. Costs for acquiring entirely new skills or entering a different profession are considered capital expenditure and cannot be claimed. For example, a self-employed plumber taking a bookkeeping course to improve administrative skills is allowable, but training for a new trade is not.

Incorrect claims, however, can lead to HMRC rejections, as detailed below.

Mistakes to Avoid

It’s important not to claim for training unrelated to your current role. For instance, a sportswear shop owner studying for a sports science degree or an unemployed person training to become a driving instructor for a future business would not qualify.

"No deduction is due for the costs of training which employees decide to do at their own expense."

This exemption applies only when the employer covers or reimburses the training costs. Another common error is failing to provide adequate documentation. Claims without proper receipts, invoices, or proof of payment are likely to be rejected, so maintaining thorough records is essential.

Additionally, avoid treating training as a disguised reward. If a course serves both as training and a reward, the cost must be split, with only the training portion being deductible. Contractors should also exercise caution - if clients directly pay for training, HMRC might interpret this as "disguised employment" under IR35 rules.

Summary

In the UK, whether you’re eligible for tax relief on training costs depends on your employment status and the type of training undertaken. If you’re self-employed, you can deduct training expenses that enhance your current business skills or help you stay updated with industry developments. However, you cannot claim for courses aimed at starting a new trade or unrelated business ventures. For employees, tax relief is generally available only if the employer pays for or reimburses the training. Self-funded courses, unfortunately, do not qualify for relief.

The rules around allowable expenses focus on specific tests. For the self-employed, the training must meet the "wholly and exclusively" test, meaning it should directly relate to your existing business. For employees, the training must be "work-related" to qualify. Courses that enhance knowledge relevant to current duties are usually allowable, while those taken for personal interest or as a reward remain taxable. Additional costs, like travel, books, or assessment fees, can often be claimed if the training itself qualifies for relief.

Proper documentation is crucial when claiming tax relief. HMRC requires clear evidence linking the training to your business or job role, particularly during audits. Avoid claiming for new ventures, splitting costs with mixed purposes, or including expenses unrelated to work. Keep detailed records, including receipts, invoices, and proof of payment, to ensure your claims comply with HMRC standards and maximise your potential relief.

FAQs

Can self-employed people in the UK claim tax relief on training costs?

Yes, self-employed individuals in the UK can claim tax relief on training expenses, but only if the training is directly connected to their current trade or supports the operation of their existing business. For instance, courses that improve skills relevant to your profession or help sustain business activities may qualify.

However, training aimed at learning entirely new skills for a different trade or career path does not qualify for tax relief. To meet HMRC’s criteria, ensure the training is clearly aligned with the needs of your current business.

What documents do I need to claim tax relief on training expenses in the UK?

To claim tax relief on training expenses, make sure you retain the invoice or receipt for the training and proof of payment. Additional documents, such as attendance certificates or receipts for associated expenses like travel or materials, may also be necessary. These records are essential for supporting your claim if HMRC requests verification.

How can employees in the UK claim tax relief on training costs they’ve paid themselves?

Employees have the option to claim tax relief on training expenses they’ve personally covered, provided the training is directly linked to their current job and they’ve paid tax during the same financial year. This can be done by either including the expenses in their self-assessment tax return or reaching out to HMRC to request a change to their tax code.

It’s essential to keep documentation, such as receipts or invoices, as HMRC may require proof to validate the claim. However, the training must specifically support the requirements of the employee’s existing role and cannot be for acquiring new skills unrelated to their job.