The Apprenticeship Levy is a UK funding system for organisations with annual pay bills over £3 million. It allows businesses to allocate funds towards leadership training through approved apprenticeship standards. Employers contribute 0.5% of their pay bill, minus a £15,000 annual allowance, with a 10% government top-up added to their levy account. Funds must be used within 24 months or will expire.

Leadership training funded by the levy includes programmes for current managers, such as Level 3 Team Leader or Level 7 Senior Leader apprenticeships. Smaller businesses can access the same training through a co-investment model, covering only 5% of costs. From January 2026, reforms will restrict Level 7 funding to younger staff and increase employer co-investment rates.

This article explains how to use levy funds, manage accounts, and enrol employees in leadership programmes. It also highlights upcoming changes and other funding options for leadership training. Visit the Leadership Training Hub to compare providers and find suitable programmes.

Management & Leadership apprenticeships for Primary Care

Common Problems When Using the Levy for Leadership Training

While the Levy offers organisations a valuable opportunity to fund leadership development, many face challenges in accessing and utilising these funds effectively. Two key issues often stand in the way of employers making the most of their apprenticeship service accounts.

Confusion About Which Programmes Qualify

The rules governing Levy funding change annually (August–July), which can make it difficult to determine which leadership programmes are eligible. Importantly, organisations must adhere to the rules in place at the time an apprentice starts their programme, rather than the most recent updates.

Shifting terminology also creates confusion. For instance, changes from terms like 'commitments' to 'approved apprenticeship records' can delay enrolments. Uncertainty persists around which training and assessment costs the Levy will cover. For Level 7 leadership apprenticeships, many employers struggle to differentiate between a standard MBA or Master's degree and a Levy-compliant Level 7 apprenticeship standard.

Geographic restrictions add another layer of complexity. Levy funding is tied to the "English percentage" - the proportion of a company’s pay bill attributed to employees living in England. This can complicate funding for leadership initiatives aimed at teams spread across the UK. To stay informed, organisations should review the "Summary of Changes" documents published by the Department for Education with each new set of funding rules.

These challenges often result in unspent or misallocated funds, increasing the risk of missed opportunities.

Funding Expiry and Spending Limits

Levy funds have a strict 24-month expiry period, meaning any unused funds are forfeited after two years. This "use it or lose it" policy requires organisations to carefully align their programmes with the Levy cycle. Additionally, if programme costs exceed the funding band maximum, employers must cover the difference out of pocket.

Transfers further complicate fund management. When funds are transferred to another business, they are deducted before any internal apprenticeship payments are made. Without careful monitoring, this can result in unexpected shortfalls.

How to Use Levy Funding for Leadership Training

Accessing funds for leadership training is straightforward if you follow the government's guidelines.

Who Can Use the Levy and What It Costs

Businesses with an annual pay bill over £3 million are required to pay the Apprenticeship Levy. This is calculated at 0.5% of their total pay bill, minus a fixed annual allowance of £15,000. For example, a business with a £5 million pay bill would owe (£5,000,000 × 0.5%) − £15,000, which equals £10,000. Additionally, the government adds a 10% top-up to the funds in the apprenticeship service account.

For smaller businesses with pay bills under £3 million, the Levy does not apply. However, they can still access leadership training through a co-investment model. Under this scheme, the government covers 95% of training costs (up to the funding band limit), with the employer paying the remaining 5%. For instance, if a Level 5 Operations Manager apprenticeship costs £7,000, the employer's contribution would be just £350.

Levy-paying businesses that exhaust their account funds also switch to the co-investment model. Additionally, they can transfer up to 50% of their unused funds to other organisations, such as suppliers or partners. The recipient business would then cover 100% of training costs, up to the funding band maximum.

Once you’ve confirmed your funding, you can proceed to enrol employees in approved leadership training programmes.

How to Enrol Employees in Levy-Funded Leadership Programmes

To manage funding and enrolments, log in to your account using GOV.UK One Login. You’ll need your PAYE scheme reference number and accounts office reference number during registration. Non-levy payers must reserve funding in their account’s finance section, which can be done up to three months before the training start date.

Next, select an approved training provider and choose a relevant leadership apprenticeship standard, such as Level 3 Team Leader or Level 5 Operations Manager, using the "Find apprenticeship training" service. You’ll also need to complete and sign the Contract of Employment, Apprenticeship Agreement, and Training Plan.

Leadership apprenticeships require at least 20% off-the-job training - equivalent to about six hours per week - during normal working hours. This time must be dedicated to learning new skills, knowledge, and behaviours, separate from regular job responsibilities. You’ll also need to select an independent End-Point Assessment Organisation (EPAO) at the start of the programme, ensuring the assessment cost stays within 20% of the funding band maximum. Note that apprentices must spend at least 50% of their working hours in England to qualify for funding.

To compare approved leadership training providers, including their pricing and delivery formats, visit the Leadership Training Hub's UK directory.

sbb-itb-fa39ac2

Using Your Levy Funds Before the 2026 Reforms

Changes to apprenticeship funding rules are coming in 2026, making it crucial to use your current levy balance effectively.

Act Before December 2025

The key date to keep in mind is 31 December 2025. After this deadline, public funding for Level 7 apprenticeships - postgraduate-level leadership programmes - will only be available for learners aged 16–21. To secure levy funding for senior staff and managers aged 22 and over, enrol them before this cut-off.

Steven Hurst, Director of Corporate Learning at Arden University, highlights the urgency:

With Levy funding for new Level 7 apprenticeship starters aged 22 and over ending in January 2026, HR leaders must capitalise on current funding before the December cut-off.

Start by conducting a skills audit to pinpoint employees who would benefit most from Level 7 leadership development. Then, collaborate with approved training providers to ensure applications are submitted in time.

From January 2026, further reforms will shorten the levy fund expiry period to 12 months, remove the 10% top-up, and increase the co-investment rate from 5% to 25%.

These changes mean it’s also worth exploring other funding solutions for future leadership training.

Other Funding Options for Leadership Training

To avoid losing unused funds, consider transferring them to other organisations.

For leadership development that isn’t covered by apprenticeship standards - such as modular programmes or executive coaching - direct funding will be necessary. The Leadership Training Hub directory allows you to compare UK providers, including their pricing and delivery formats, to plan your non-levy training budgets effectively.

Apprenticeship Levy vs Growth & Skills Levy (2026)

Apprenticeship Levy vs Growth & Skills Levy 2026 Comparison

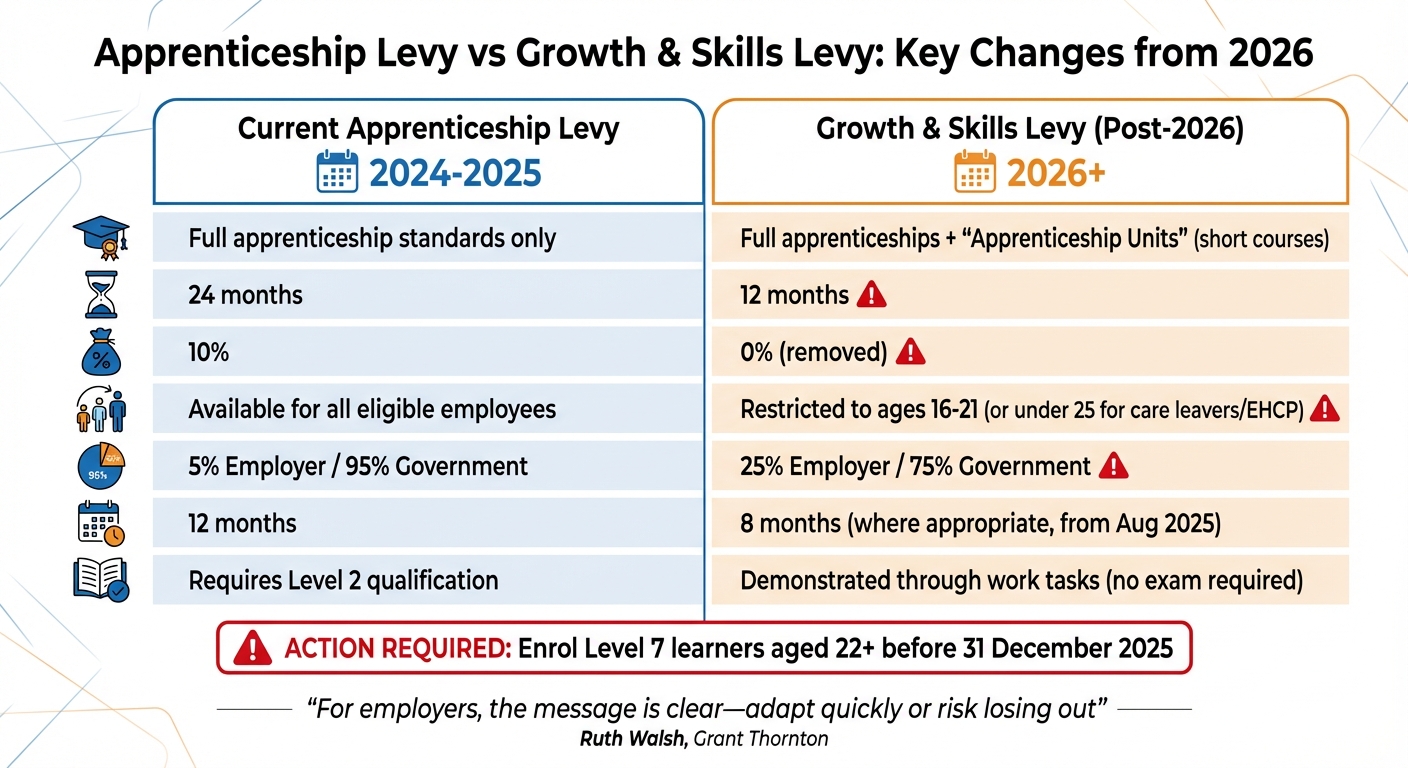

Changes to the apprenticeship funding system are on the horizon for 2026. Preparing now can help you allocate your leadership training budgets effectively and ensure continued access to funding and programmes. Below, we break down the key updates and what they mean compared to the current system.

Level 7 funding will see new restrictions, becoming available only to specific age groups. Employers should aim to enrol eligible senior staff before December 2025 to avoid missing out.

From April 2026, the system will shift to the Growth & Skills Levy, introducing "apprenticeship units." These shorter, modular courses will focus on areas like digital advancements and AI. While these units offer more flexible learning options, the initial rollout will not prioritise leadership training. Additionally, the minimum duration for apprenticeships will drop from 12 months to 8 months as of August 2025.

Financial changes include the removal of the 10% government top-up, a reduction in the fund expiry window to 12 months, and an increase in the co-investment rate to 25% from 2026/27.

Comparison: Current Levy vs Growth & Skills Levy (2026)

The table below highlights the primary differences between the current Apprenticeship Levy and the upcoming Growth & Skills Levy.

| Feature | Current Apprenticeship Levy | Growth & Skills Levy (Post-2026) |

|---|---|---|

| Eligible Training | Full apprenticeship standards only | Full apprenticeships + "Apprenticeship Units" (short courses) |

| Fund Expiry Window | 24 months | 12 months (from 2026/27) |

| Government Account Top-up | 10% | 0% (removed from 2026/27) |

| Level 7 Eligibility | Available for all eligible employees | Restricted to ages 16–21 (or under 25 for care leavers/EHCP) |

| Co-investment Rate (When Funds Exhausted) | 5% Employer / 95% Government | 25% Employer / 75% Government (from 2026/27) |

| Minimum Duration | 12 months | 8 months (where appropriate, from Aug 2025) |

| English & Maths (19+) | Requires Level 2 qualification | Demonstrated through work tasks (no exam required) |

Ruth Walsh, Head of Talent Solutions at Grant Thornton, emphasises: "For employers, the message is clear - adapt quickly or risk losing out".

Summary

The Apprenticeship Levy continues to be an important funding source for leadership training, but changes on the horizon could impact how organisations benefit from it. Employers with annual payrolls exceeding £3 million contribute 0.5% of their payroll to the levy, with an additional 10% top-up provided by the government. However, funds in the apprenticeship service account expire after 24 months if unused.

To apply levy funds towards leadership training, organisations need to establish an apprenticeship service account and choose an approved leadership standard within the relevant funding band. Costs, including the End-Point Assessment (capped at 20% of the band maximum), must comply with funding rules. Employers also have the option to transfer up to 50% of unused funds each year to supply chain partners or other organisations.

Significant changes are scheduled for 2026, which will reduce some of the current benefits. The expiry period for funds will be cut to 12 months, the 10% government top-up will be removed, and the co-investment rate for additional funds will rise from 5% to 25%. Furthermore, from 1 January 2026, Level 7 funding will only apply to younger apprentices, meaning employers will need to self-fund training for staff aged 22 and over.

To make the most of your levy contributions, it’s crucial to act now. Review your apprenticeship service accounts, prioritising funds that are close to expiring, and enrol eligible senior staff before the reforms take effect. Additional options include transferring surplus funds or considering alternative training pathways such as foundation apprenticeships or the shorter eight-month programmes launching in August 2025.

For more detailed guidance on managing your apprenticeship levy and finding the right training provider, visit Leadership Training Hub (https://leadershiptraininghub.com).

FAQs

How can small businesses in the UK use the Apprenticeship Levy to fund leadership training?

Small businesses in the UK have a valuable opportunity to reduce the cost of leadership training through the Apprenticeship Levy. If your business doesn't contribute to the levy, the government covers up to 95% of apprenticeship training costs, making it an accessible option for developing leadership skills within your team. For those who do pay into the levy, these funds can be used to fully or partially cover the cost of approved training programmes.

This funding provides an excellent way for small businesses to strengthen their teams, enhance management skills, and support growth while keeping expenses manageable.

What changes to the Apprenticeship Levy are planned for 2026?

From 2026, the Apprenticeship Levy will undergo several updates designed to offer greater flexibility and accessibility. Among the key changes is a reduction in the minimum duration for certain apprenticeships, which will drop from 12 months to 8 months where suitable. Additionally, new training options will be introduced to improve both growth opportunities and the quality of programmes.

These updates are part of a wider initiative to streamline the scheme, making it more aligned with organisational needs. The goal is to help businesses make more effective use of their levy funds to invest in workforce development and leadership training.

How can organisations avoid losing unused Apprenticeship Levy funds?

To make the most of your Apprenticeship Levy funds, it's crucial to allocate and use them within the two-year expiry period. Any funds left unspent after this timeframe are returned to the government, with no option to recover them.

Planning ahead is key to avoiding this loss. Start by assessing your organisation's training needs early - this could include leadership development programmes - and ensure funds are channelled into appropriate apprenticeship schemes. Partnering with training providers or platforms experienced in leadership and executive development can simplify the process and help you use the funds effectively.